According to the results of a new survey released by global professional services firm, Deloitte, less than half of professionals have confidence in the ability of their organizations’ finance teams to collect and report on financial metrics for environmental, social and corporate governance (ESG) factors, citing data collection and staffing shortages as the main challenges.

According to the Deloitte release, the survey was conducted among more than 3,000 professionals, and also indicated that very few organizations have hired dedicated ESG reporting professionals, despite the significant perceived benefits.

“It is concerning to see so few respondents reporting confidence in their ESG reporting as we await new U.S. regulatory guidance on climate reporting requirements,” said Dina Trainor, Managing Director of Deloitte Risk & Financial Advisory.

“Now is the time to take a hard look at your organization’s current ESG reporting capabilities and protocols and undertake the necessary improvements. The good news is that there are clear actions organizations can take that have a strong correlation to building confidence in ESG reporting,” Trainor added.

You may also be interested in | Beyond 2023: Five Green Trends for the Next Five Years

Results

According to Deloitte, only 45.7% of respondents reported having confidence in the ability of their organization’s finance team to collect and report on ESG metrics such as DEI (diversity, equality and inclusion), sustainability and governance for compliance purposes.

However, the survey revealed that confidence in ESG reporting capabilities increased significantly if organizations had dedicated ESG reporting staff, or if finance teams were involved in ESG issues.

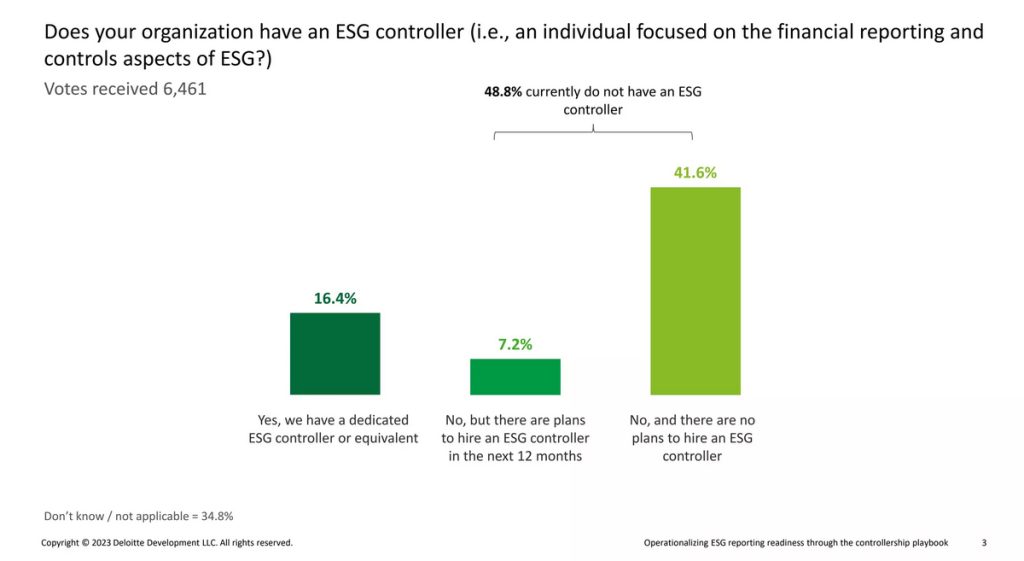

Professionals in organizations with an “ESG controller,” or a person focused on financial reporting and controls issues, reported 75.5% confidence in their organization’s reporting capabilities, 30 percentage points higher than those without such a position.

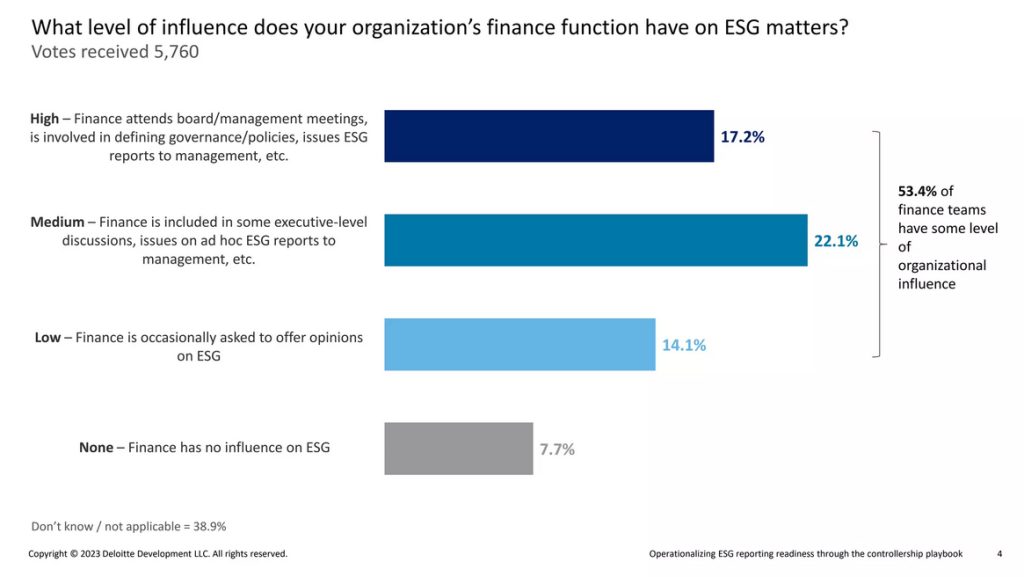

Similarly, professionals in organizations where finance teams had some level of influence on ESG issues were more than twice as likely to report confidence in ESG reporting, at 60.7%, compared to only 27.2% in organizations without finance function influence on such factors.

Despite the confidence gap uncovered by the survey, fewer than one in five respondents (16.4%) said their organizations have an ESG controller, 41.6% reported no plans to hire one, and only 7.2% reported plans to add such a position in the next year.

53.4% of practitioners reported that their finance teams have some level of influence on ESG issues, with only 17.2% reporting a “high” level of influence, such as attending board or management meetings, participating in setting policy, or issuing reports to management.

More data

The survey also examined the challenges faced by controllership teams in their ESG efforts, with data collection cited as the biggest challenge by 26.3% of practitioners, followed by a shortage of appropriately qualified staff to support ESG controllership issues at 17.6%, and changing organizational processes to enable effective reporting at 17%.

Practitioners in organizations with an ESG controller were much more likely to point to data collection as the top challenge, at nearly 40%.

The survey’s low confidence ratings come at a time when organizations around the world are increasingly expected to meet regulatory requirements to report on their climate and sustainability-related risks, opportunities and plans, with the introduction of new ESG disclosure requirements in jurisdictions such as the US, EU and UK, among many others.

To view the survey results, click here