David Brown, Energy Transition Director at the firm Wood Mackenzie, wrote an article linked to a study conducted by the consultancy on Colombia’s potential to lead the energy transition in Latin America, following the company’s Energy Transition Service and Wood Mackenzie Lens. The publication follows:

Oil and gas exploration has been at the center of Colombia‘s national energy strategy and that of its Empresa Nacional de Petróleos, Ecopetrol. But as the world decarbonizes and Colombia focuses on its own goal of zero net emissions, the winds of change are blowing. How can the country now become a regional leader in a sustainable approach to energy?

While the aftermath of the energy crisis has driven investment in oil and gas in the short term, decarbonization is a structural trend driven by economics and politics. For example, electric vehicle (EV) costs are already on par with those of the internal combustion engine (ICE) in major markets.

You may also be interested in | New study: “Institutional investors’ carbon exposure increases even as emissions intensity decreases”

Colombia’s Repositioning for a Lower Carbon Future

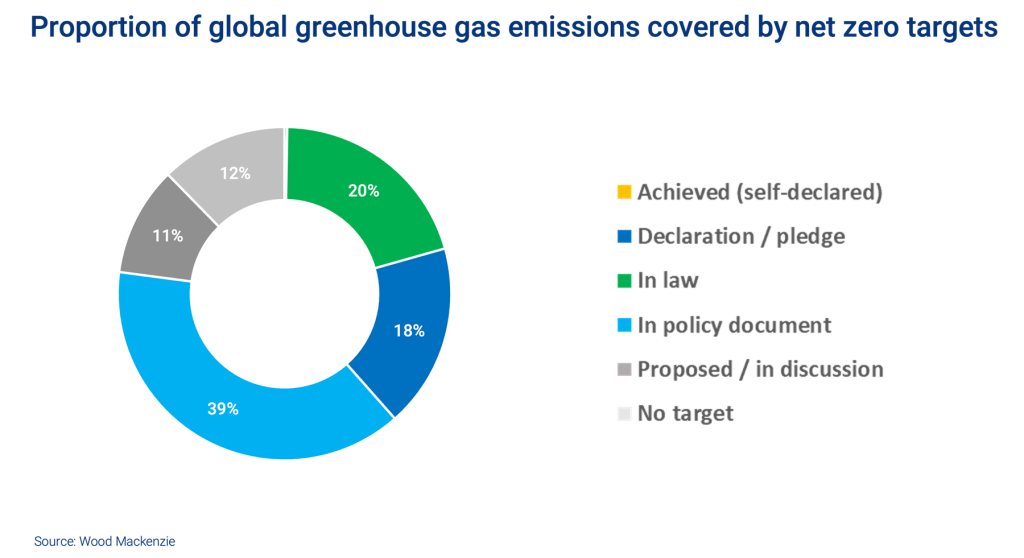

Net-zero emissions targets cover 88% of global emissions, and the associated policy will incentivize investment in zero-carbon technology and a shift away from fossil fuels. As expected, announcements from companies around the world show that spending on new energy will accelerate.

Colombia produced about one million barrels per day (mb/d) of oil in 2022 and has valuable product exports to the United States. But US efforts under the IRA are designed to push decarbonization toward a 1.5-degree pathway. On this pathway – which we explore in our AET-1.5 scenario – oil demand in the US transportation sector could fall to less than 1 mb/d by 2050. This would put Colombia’s liquids exports at serious risk.

As governments and markets around the world focus on how to achieve net zero, the sources of value creation in the energy market will change dramatically.

So how can Colombia maximize its positive exposure to this trend?

Colombia Could Diversify into Metals Exports

Colombia is already a small nickel producer and could shift its production from ferronickel to nickel sulfate, used in electric vehicle batteries. Colombia is also one of the 20 governments that has a Free Trade Agreement (FTA) with the United States. This is a key piece of trade policy in place that could support the expansion of trade with the United States in the wake of the IRA.

Colombia also has significant reserves of copper, another essential metal for the energy transition. More exploration and clarity on permitting are needed to increase production.

Green Light for Low-Carbon Hydrogen

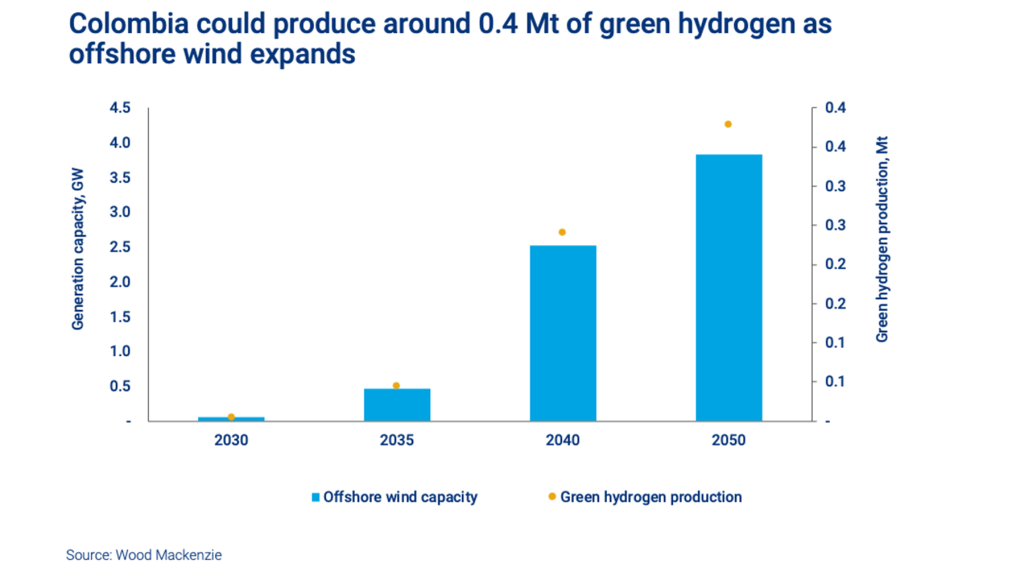

With the expansion of wind and solar power, we expect lower electricity costs to help green hydrogen produced in Colombia become economically competitive with current forms of hydrogen production and some fossil fuel sources in the 2030s.

Hydrogen-to-energy strategies are key to decarbonization pathways in Europe and Asia, making them key potential export markets for Colombian-produced hydrogen. We estimate that the levelized cost of hydrogen (LCOH) in Colombia could be similar to that of Chile. Colombia’s potential export volumes would be globally competitive, especially in Europe.

Colombia Can Expand Position in the Global Carbon Offsets Market

Our outlook for carbon offsets suggests that, in a net-zero scenario, global demand could increase to around five billion tons by 2050.

Colombia has great potential to increase its investment in offsets, especially in the forestry and land use markets. Projects that can provide high-quality offsets will be able to command a premium in the market.

For Colombian energy giant Ecopetrol, the carbon credit agreement between the Government of Guyana and Hess Corporation is a valid case study.

Ecopetrol has a similar total emissions profile to Hess, and the agreement is considered a benchmark in the sector because of its structure, potential scale and the implications for Hess‘s overall emissions.

Seizing the CCUS Opportunity

Given the costs of the technologies involved, some level of government support will be necessary for carbon capture, utilization and storage (CCUS) to realize a return on capital.

Colombia has not yet announced any CCUS projects, despite having a net zero target and CCUS storage potential.

The Colombian government has expressed political support for low-carbon hydrogen; to meet its net-zero emissions target, CCUS needs to be part of the equation in Colombia as well.

To read the original article, click here