Solar PV is on track to attract more capital than oil production globally this year for the first time in history, according to the International Energy Agency‘s (IEA) report, “World Energy Investment 2023.”

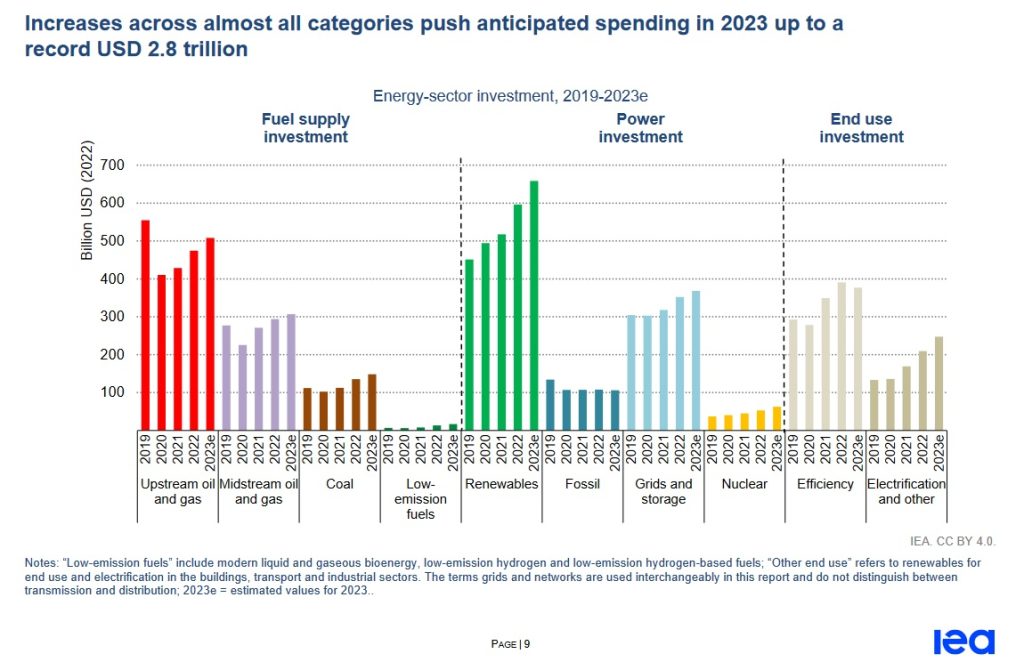

According to the report, global energy investment will reach $2.8 trillion in 2023, up from $2.6 trillion last year.

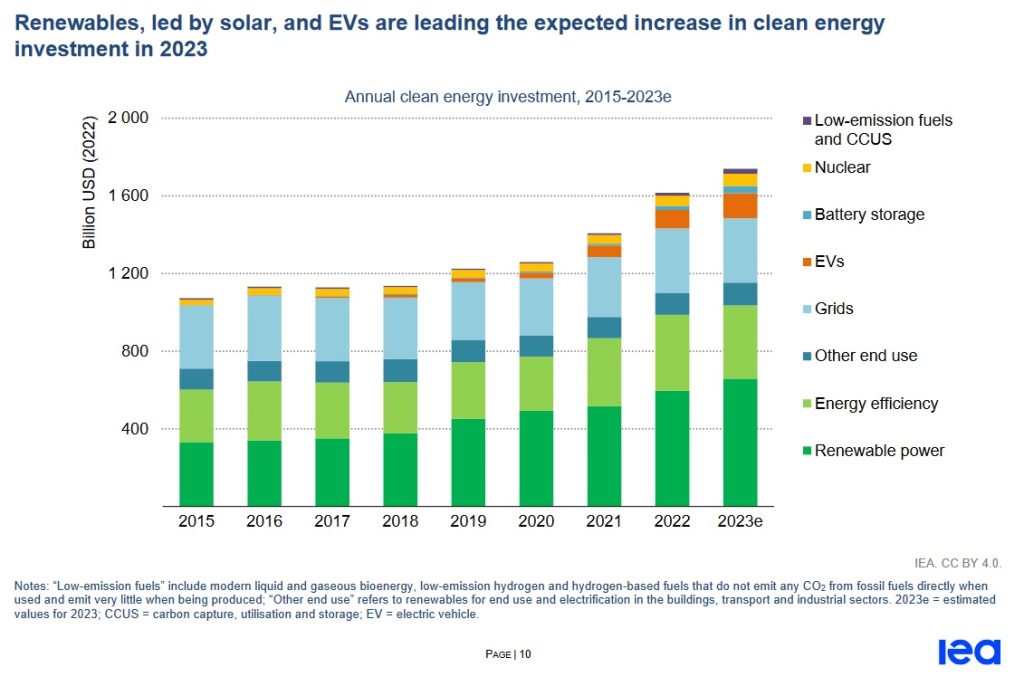

Most of the increase will be due to growth in clean energy categories such as renewables, nuclear, grids, storage, low-emission fuels, improved efficiency and end-use renewables, and electrification.

You may also be interested in | Wood Mackenzie: “How Colombia Could Lead the Energy Transition in Latin America”

Clean Investments

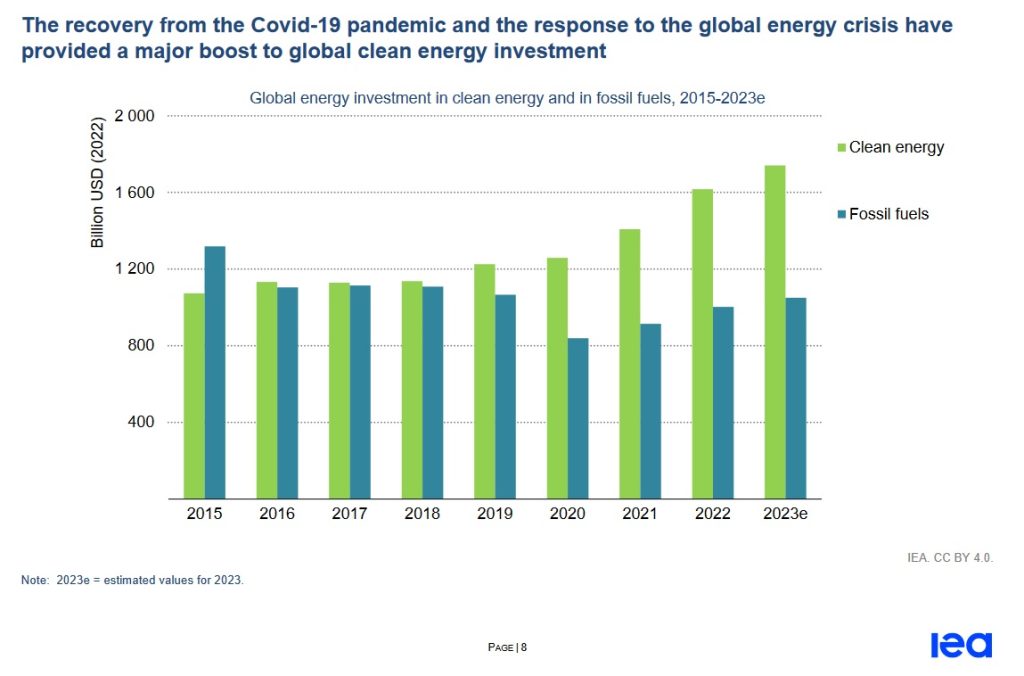

Investment in clean energy is expected to reach more than US$1.7 trillion this year, a year-on-year increase of around 8% and more than 50% over the last five years, when investment in clean energy and fossil fuels was roughly equal at US$1.1 trillion each.

The main driver of clean energy investment growth is renewables, which will attract more than $650 billion in capital in 2023, 11% more than in the same period last year, and 75% more than in the last five years.

The rapid growth of electric vehicles is also emerging as a significant contributor to the increase, up more than 800% from 2018 to nearly $130 billion this year.

The two categories combined account for roughly two-thirds of the increase in clean energy investment over the past five years.

More Details

Within renewables, solar PV has been the key driver of growth, attracting approximately $380 billion in capital this year, or more than $1 billion a day, and outpacing investment in upstream oil production, estimated at about $370 billion, for the first time in history.

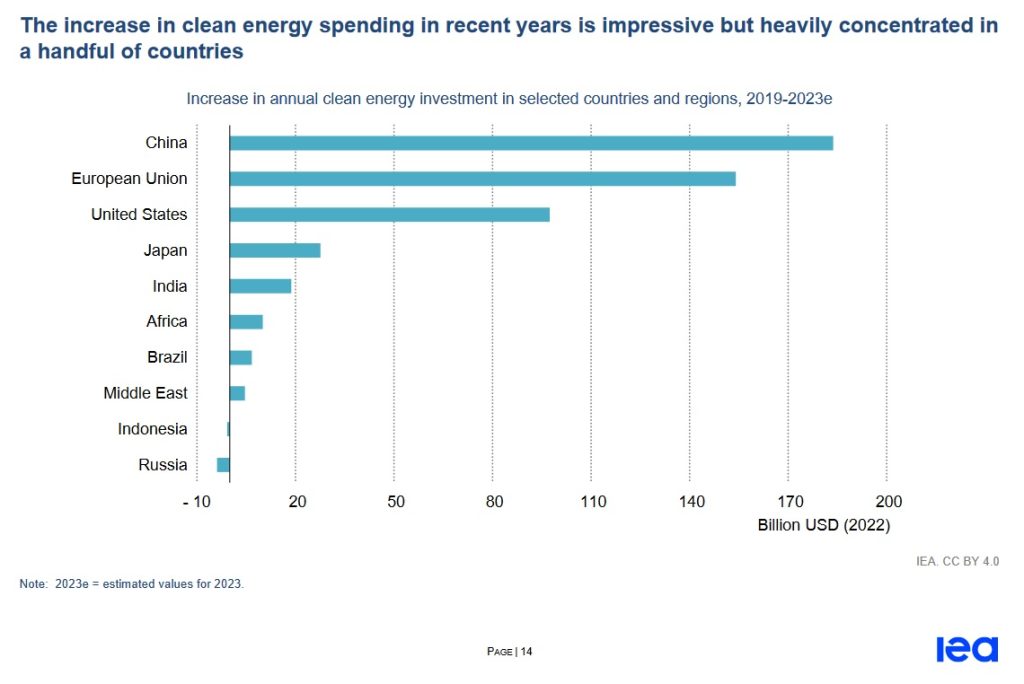

The report also shows a significant concentration in the sector, with more than 90% of investment growth over the past two years taking place in China and advanced economies such as the EU and US.

The report also revealed that while clean energy investment is outpacing fossil fuels, the latter category has seen a steady increase in investment growth since its sharp decline in the COVID era, and is forecast to reach approximately $1.05 trillion this year, roughly similar to 2019 levels.

Spending on oil and gas exploration and production will grow 7% this year, although the report notes that national oil companies in the Middle East are among the only oil producers increasing investment, while increased spending on natural gas appears to be driven primarily to offset the loss of supply following the war in Ukraine.

“Clean energy is advancing rapidly, faster than many people think. This is clear in investment trends, where clean technologies are moving away from fossil fuels. For every $1 invested in fossil fuels, about $1.7 is now going to clean energy. Five years ago, this ratio was one to one”

Fatih Birol, IEA executive director