Total sustainable debt issuance hit a record high in 2021 and is poised for further growth in 2022, but market participants will be challenged to manage that growth and combat rising concerns about greenwashing.

Many companies set sustainability targets and published data related to environmental, sustainability and corporate governance (ESG) metrics, but investors, regulators and the general public are exercising greater scrutiny on companies’ efforts.

S&P Global conducted a review of the key ESG trends for 2022, which it estimates will influence the prospects for meaningful progress, and considers them in a linked way.

Increased Pressure on Companies and Leaders

In 2022, company boards and government leaders will face increasing pressure to demonstrate that they are adequately equipped to understand and monitor ESG metrics.

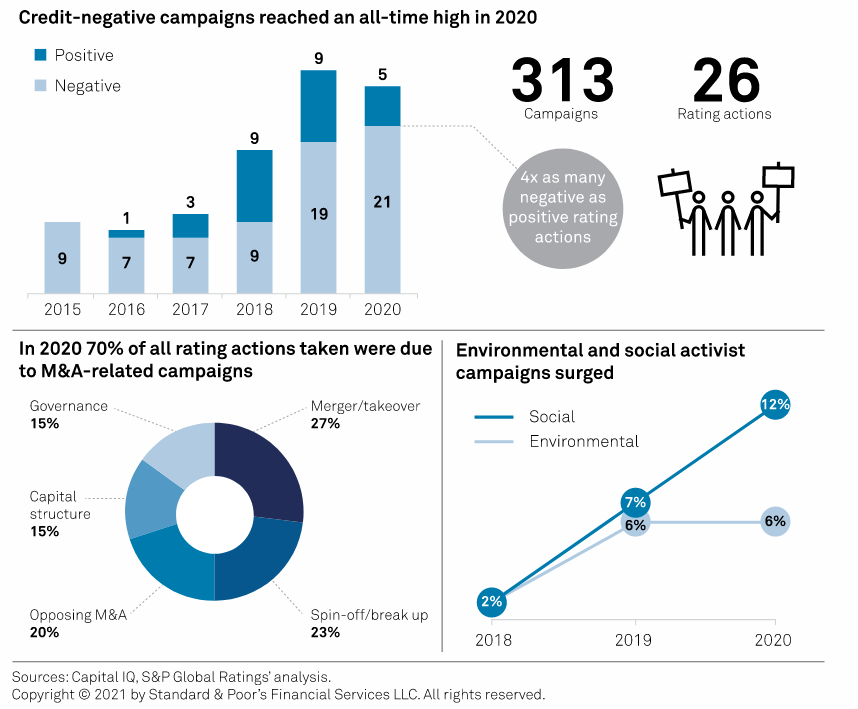

Shareholder activism in this area increased in 2021, including votes against directors for lack of credible climate action plans, and S&P Global believes this trend will accelerate in this year’s quarterly reports.

In addition, efforts to diversify boards and create policies that promote equity and inclusion will continue to evolve. Government and corporate leaders will be under pressure to strengthen their ESG competencies and integrate sustainability into their policy and planning strategies.

In particular, adaptation and resilience measures will be added to investment plans amid the growing economic impact of climate change. In 2021, the United States alone experienced 20 storms with losses in excess of $1 billion each.

New Regulations, Increased Credibility

While many large companies set sustainability targets and published ESG data in 2021, investors, regulators and the general public are exercising greater scrutiny of companies’ sustainability efforts, calling out what they perceive as «greenwashing.»

Much of this skepticism is based on concerns that companies may be using sustainability-related disclosures, and labels on products and services, as a marketing tool to appear more proactive than they really are.

New global ESG-related standards will continue to evolve in 2022, while global standard-setting organizations, such as the newly created International Sustainability Standards Board, can help address what may be the biggest obstacle to accountability: the lack of a common basis for consistent disclosure standards across jurisdictions and industries.

To date, agreement on key metrics and reporting frameworks for environmental factors has crystallized more quickly than for social factors. But by 2022, there could be greater convergence on more relevant data, metrics and reporting requirements for social issues, along with increased pressure to ensure that they measure impact, not just inputs.

Turning Pledges into Action

In 2021, the number of governments and companies setting targets to achieve net zero emissions by 2050 grew rapidly, but often lacked interim emissions reduction targets, or plans to curb indirect emissions occurring throughout the supply chain.

In 2022, S&P Global believes that pressure will increase from shareholders and other stakeholders for these entities to develop concrete near-term plans and begin to act to address emissions across the value chain.

This year, the UN’s Intergovernmental Panel on Climate Change (IPCC) will release new reports that could recalibrate how quickly the world must act to stay within the goal of limiting global warming this century to 1.5°C relative to pre-industrial levels.

Governments and businesses will need to provide credible and achievable near-term signals on their path to decarbonization, with attention to how entities manage exposure to climate risks, including the presence and adequacy of adaptation and resilience planning. Such expectations will begin to hold entities accountable for their commitments and help address market perceptions of greenwashing.

Social Aspects

Efforts to promote the low-carbon economy may be disrupted in the absence of credible plans to boost economic and social inclusion, access to affordable critical services, and the availability of decent work.

In its report, S&P Global notes that at COP26 in November 2021, more than 30 countries signed commitments to support workers and communities harmed by the transition to a green economy. In the face of potential economic headwinds, support provided to emerging markets to balance climate goals with those of economic growth and poverty alleviation will profoundly affect social stability and the momentum of the global climate agenda.

Climate stress testing the financial sector

One of the key takeaways for the firm is that investor pressure regarding climate change has historically been concentrated in non-financial companies, especially in the energy sector. However, major institutions and policymakers are beginning to recognize the long-term threat to financial stability.

S&P Global reviews the work of the Network for Greening the Financial System (NGFS), whereby central banks are beginning to incorporate climate risk as an element of stress testing for institutions and insurers:

- The European Central Bank’s 2021 climate stress tests showed the need for banks to improve the assessment of their exposure to both climate transition risks and physical risks in order to manage them proactively.

- In the United States, the Federal Reserve is weighing the implications of climate-related risks for institutions and the financial system, and has called scenario analysis «a key potential analytical tool for that purpose.»

- China has also been examining ways to incorporate climate change risk into its stress tests of financial institutions.

Much of the work on climate stress testing comes from global collaboration among central banks, something that S&P Global projects will continue in 2022. Insurance regulators are also taking steps to integrate sustainability, and in particular climate risks, into their prudential frameworks.

For the firm, stress tests are a useful starting point for companies to measure their climate risk. However, it believes there will be a continued development of qualitative approaches to complement such assessments.